2025 BENEFITS

We are committed to providing you with a comprehensive benefits program that provides the care you and your family need to lead healthy lives.

Before you get started, here are a few things to note:

- All full-time HORNE team members (working 30+ hours) are eligible to enroll in the benefits outlined in this guide.

- This site provides information for U.S. Mainland team members. For Puerto Rico team members, click the button at the top of the page.

HEALTH

Medical

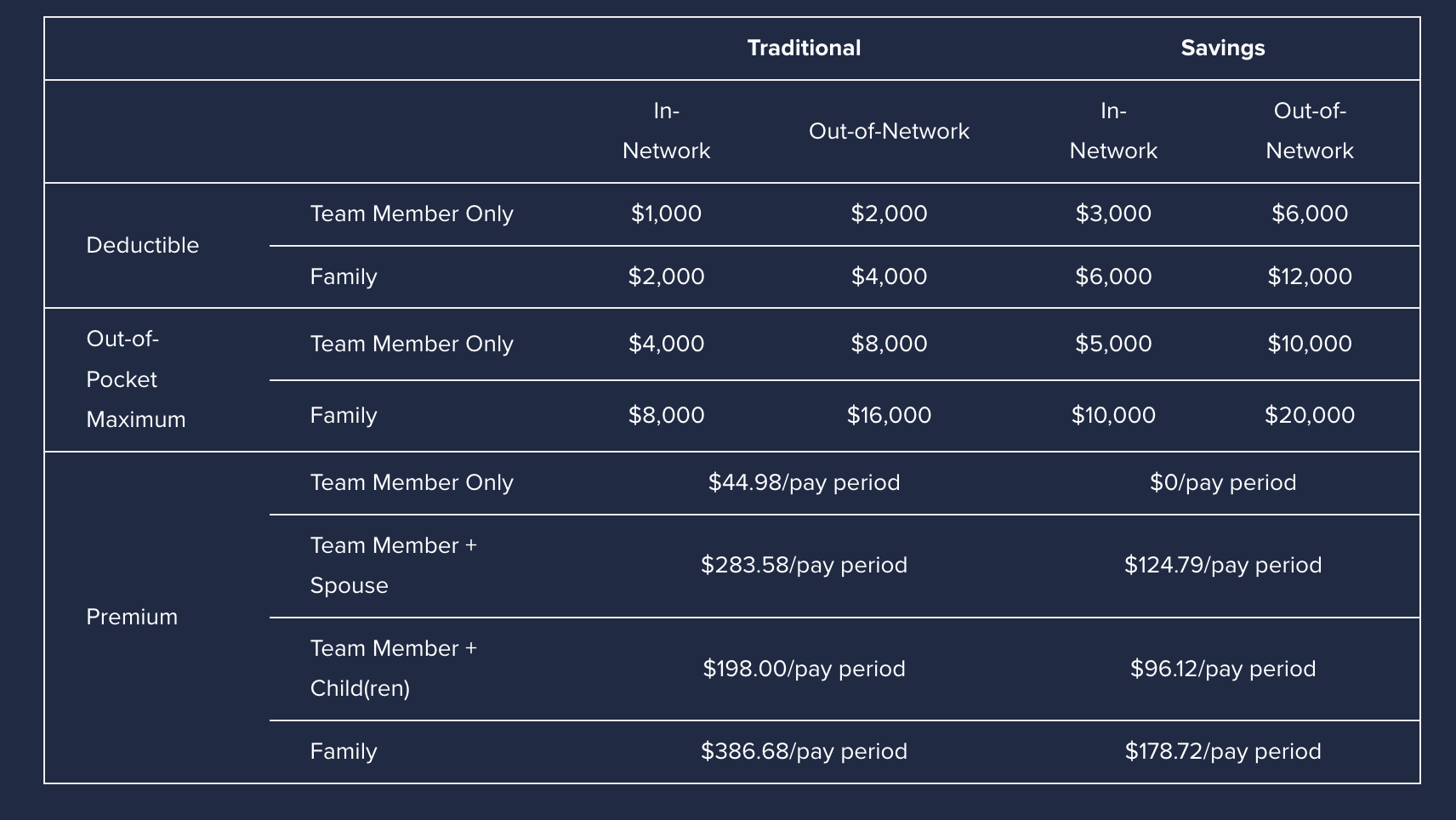

We offer two medical coverage options: a Traditional Plan (lower deductible, higher premium, not HSA eligible) and a Savings Health Plan (higher deductible, lower premium, HSA eligible).

See Rates and Details

| Traditional | Savings | ||||

| In-Network | Out-of-Network | In-Network | Out-of-Network | ||

| Deductible | Team Member Only | $1,000 | $2,000 | $3,000 | $6,000 |

| Family | $2,000 | $4,000 | $6,000 | $12,000 | |

| Out-of-Pocket Maximum | Team Member Only | $4,000 | $8,000 | $5,000 | $10,000 |

| Family | $8,000 | $16,000 | $10,000 | $20,000 | |

| Premium | Team Member Only | $44.98/pay period | $0/pay period | ||

| Team Member + Spouse | $283.58/pay period | $124.79/pay period | |||

| Team Member + Child(ren) | $198.00/pay period | $96.12/pay period | |||

| Family | $386.68/pay period | $178.72/pay period | |||

See Rates and Details

To find a doctor in the new network, go to www.umr.com and select “Find a Provider.” Search for UnitedHealthcare Choice Plus Network.

For complete details, please refer to the Benefits Enrollment Guide.

Dental

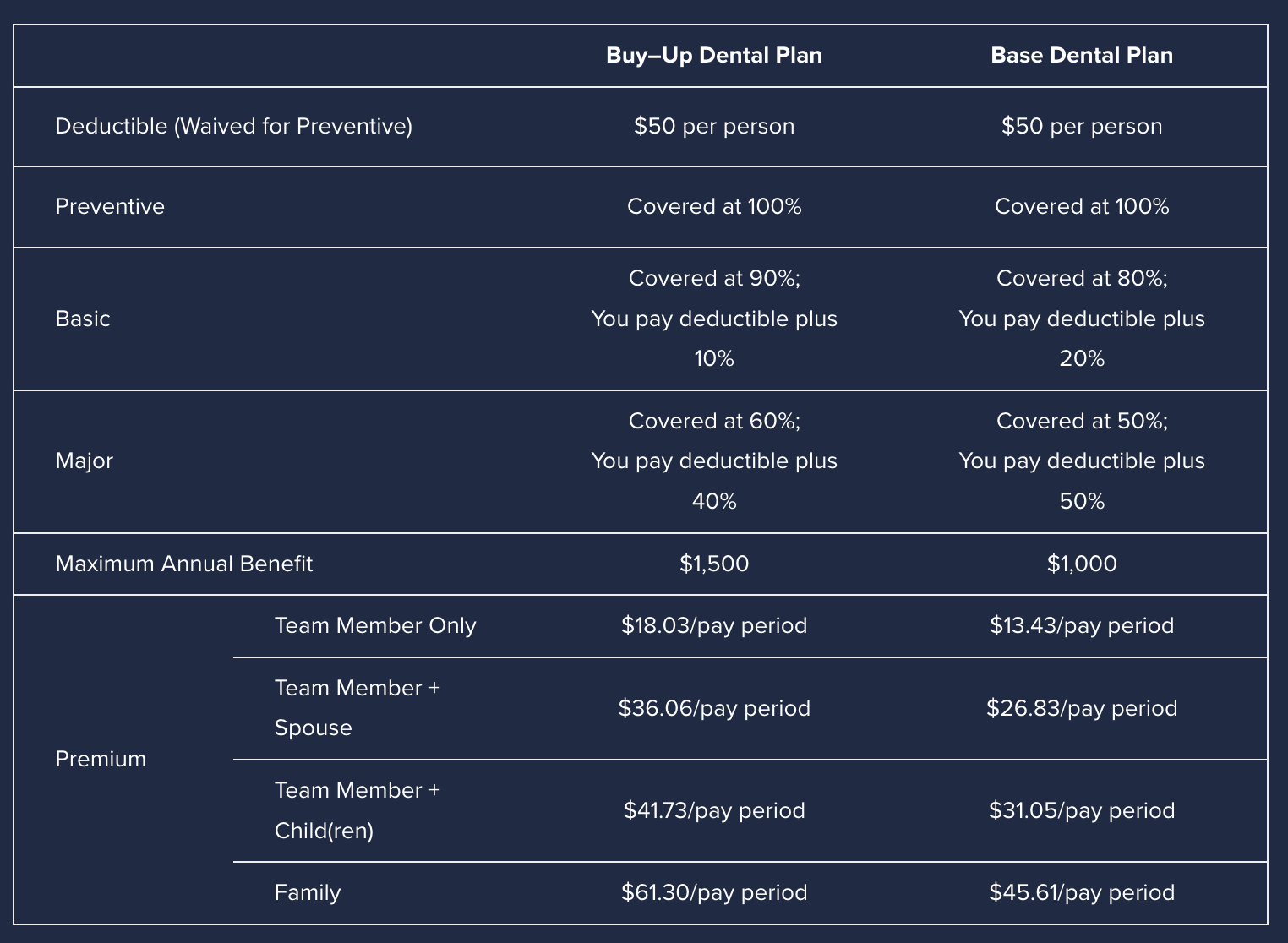

We offer two dental coverage options: a Buy-Up Plan (higher maximum benefit, higher premium) and a Base Plan (lower maximum benefit, lower premium).

You may seek care from any dentist, but by choosing in-network providers, you will lower your out-of-pocket costs. You can find an in-network provider by visiting https://www.sunlife.com/us/en/plan-members-and-families/ and click on “Find a Dentist.” When searching for a provider, please be sure to select the “PPO plans.”

For complete details, please refer to the Benefits Enrollment Guide.

See Rates and Details

| Buy–Up Dental Plan | Base Dental Plan | ||

| Deductible (Waived for Preventive) | $50 per person | $50 per person | |

| Preventive | Covered at 100% | Covered at 100% | |

| Basic | Covered at 90%; You pay deductible plus 10% |

Covered at 80%; You pay deductible plus 20% |

|

| Major | Covered at 60%; You pay deductible plus 40% |

Covered at 50%; You pay deductible plus 50% |

|

| Maximum Annual Benefit | $1,500 | $1,000 | |

| Premium | Team Member Only | $18.03/pay period | $13.43/pay period |

| Team Member + Spouse | $36.06/pay period | $26.83/pay period | |

| Team Member + Child(ren) | $41.73/pay period | $31.05/pay period | |

| Family | $61.30/pay period | $45.61/pay period | |

See Rates and Details

Vision

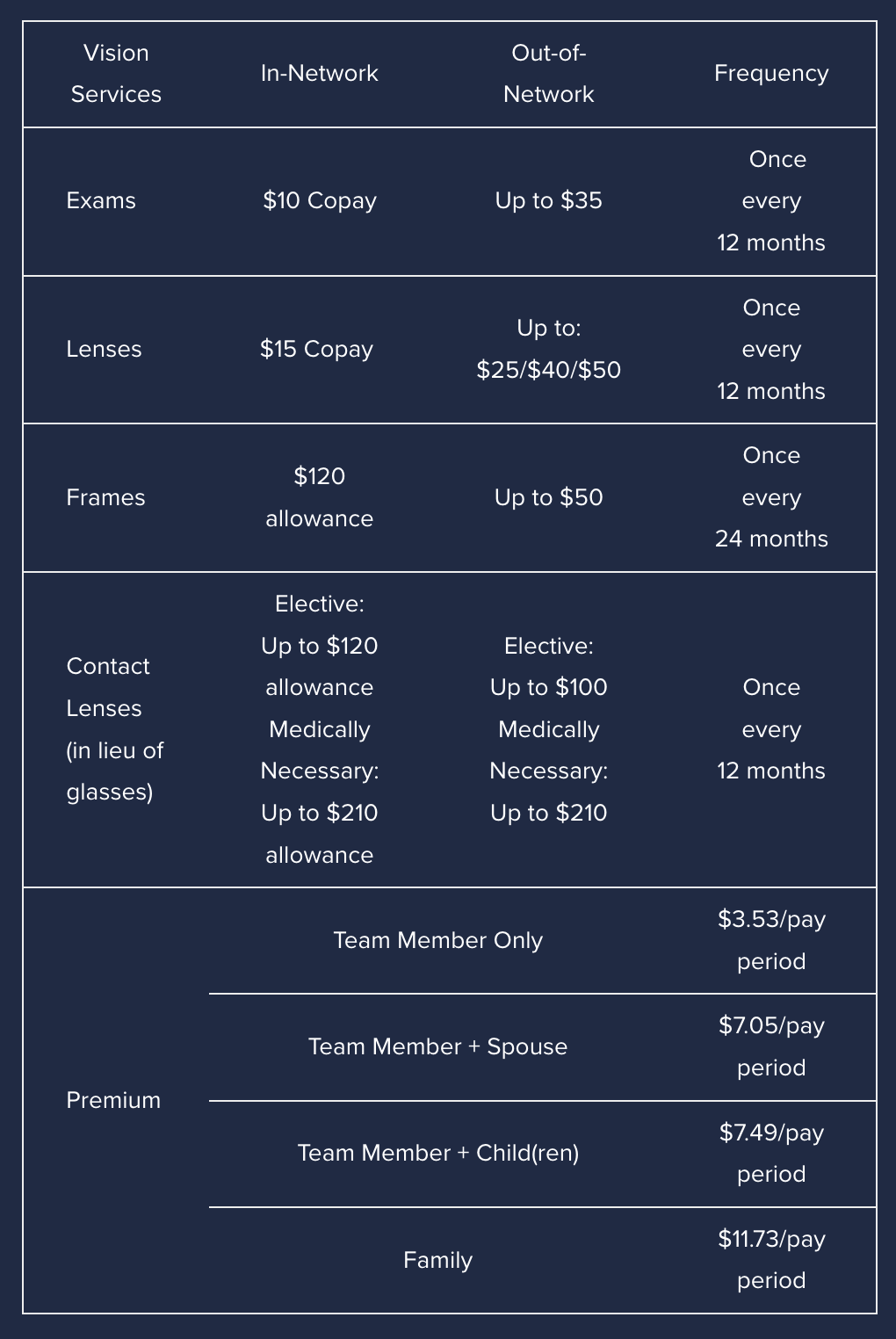

HORNE offers you the opportunity to elect vision coverage. The voluntary vision plan is offered by Unum Always Care network. You can find an in-network provider by visiting www.unumvisioncare.com and click on “Find a Vision Provider.

For complete details, please refer to the Benefits Enrollment Guide.

See Rates and Details

| Vision Services | In-Network | Out-of-Network | Frequency |

| Exams | $10 Copay | Up to $35 | Once every 12 months |

| Lenses | $15 Copay | Up to: $25/$40/$50 |

Once every 12 months |

| Frames | $120 allowance | Up to $50 | Once every 24 months |

| Contact Lenses (in lieu of glasses) |

Elective: Up to $120 allowance Medically Necessary: Up to $210 allowance |

Elective: Up to $100 Medically Necessary: Up to $210 |

Once every 12 months |

| Premium |

Team Member Only | $3.53/pay period | |

| Team Member + Spouse | $7.05/pay period | ||

| Team Member + Child(ren) | $7.49/pay period | ||

| Family | $11.73/pay period | ||

See Rates and Details

WEALTH

Health Savings Account

If you elect the Savings Health medical plan, you can enroll in a health savings account (HSA) that enables you to pay for current, qualified health care expenses and save for future expenses on a tax-free basis. You have the opportunity to set aside funds in your HSA before taxes through convenient payroll deductions.

How the HSA Works

Basically, your medical plan, along with your HSA, puts healthcare spending in your hands. With lower premiums to pay for coverage, you choose how to spend your healthcare dollars. You can either pay for eligible services by using funds in your HSA, or you can pay for them out of your own pocket. It’s important to note that you can only use HSA funds as they are deposited in your account. You can always reimburse yourself later once you have accumulated funds in your account.

Total Annual Contribution Limits

Your contributions, when combined with the firm’s contributions, may not exceed the IRS annual maximum of $4,300 for individual coverage and $8,550 for family coverage in 2025. If you choose to enroll in the Health Savings Plan, the firm will contribute $1,000 to your account. The firm will make HSA contributions once per month (about $83/month) between January – December.

Questions? Visit https://www.irs.gov/pub/irs-drop/rp-24-25.pdf for more information.

Flexible Spending Account

Flexible spending accounts (FSAs) allow you to pay for eligible health and/or dependent care expenses on a pretax basis, meaning your FSA contributions are deducted from your pay before your federal and Social Security taxes are calculated. The result is that your taxable income is reduced, and you get to keep a greater portion of your paycheck.

An FSA is a great option if you expect to incur medical, vision, dental and/or dependent care expenses that won’t be reimbursed by your benefit plans.

For a complete list of qualified health care expenses, visit: http://www.irs.gov/pub/irs-pdf/p502.pdf

For a complete list of qualified dependent care expenses, visit: http://www.irs.gov/pub/irs-pdf/p503.pdf

For more details, please refer to the Summary Plan Description.

Life Insurance

Basic Life and AD&D Insurance: Lincoln Financial Group

This benefit is paid by HORNE to help team members maintain financial security.

Important: Please make sure your beneficiary information is up to date.

Voluntary Life and AD&D Insurance

Team members must elect coverage for themselves to elect coverage for a spouse and/or dependent child(ren).

You have the option to purchase additional life and AD&D insurance at group rates. The premium is age-banded and offered voluntarily. Therefore, you will be responsible for paying 100% of the cost, which is payroll deducted on a post-tax basis.

Disability Insurance

HORNE provides eligible team members long-term disability coverage. This benefit is paid for by the firm.

Short-Term Disability

If you choose to elect Short-Term Disability coverage, you pay 100% of the cost through payroll deductions.

Extra Insurance Options

-

Accident Insurance: Voya

To protect yourself and your dependents from the financial fallout as a result of an accident, injury, or even death, you have the option to purchase voluntary accident insurance at discounted group rates. This benefit is paid for entirely by you.

-

Critical Illness Insurance: Voya

To help cover out-of-pocket health care expenses related to certain critical illnesses, you have the option to purchase critical illness insurance at discounted group rates. You and your covered spouse and dependents will receive a lump-sum payment to help cover out-of-pocket expenses related to cancer, heart attacks, strokes, benign brain tumors, major organ failure and certain childhood conditions. The lump-sum payment will vary depending on your condition. For more details, refer to the Critical Illness Insurance Plan. This benefit is paid for entirely by you.

-

Hospital Indemnity Insurance: Voya

You have the option of enrolling in the hospital confinement indemnity plan to help cover the cost of out-of-pocket expenses associated with a hospital stay (such as transportation, meals and childcare) that are not covered under our core medical coverage. This benefit provides a cash amount and is provided at an additional cost to you. This benefit is paid for entirely by you.

-

Legal Plan: ARAG Legal Insurance

ARAG Legal Insurance offers extensive legal coverage for everyday issues, including consumer protection (auto repair, consumer fraud, and home improvement), family law (adoption, divorce, and name changes), general legal needs (document review and credit record correction), and financial matters (debt collection and tax audits). It also covers home ownership issues (boundary disputes and landlord problems), traffic matters (traffic tickets and license suspensions), wills and estate planning (powers of attorney and trusts), and provides identity theft protection to safeguard personal information. This benefit is paid for entirely by you.

-

Cancer Insurance: MetLife

To help you with the added financial burden that comes from a cancer diagnosis, you may purchase cancer insurance to help you cover the cost of expenses that are not typically covered under our medical coverage.

-

Pet Insurance: Nationwide

From sunrise walks to midnight vet runs, there are many sides to caring for a furry family member. Services covered under Pet Insurance include accidents, injuries, common illnesses, hereditary & congenital conditions, x-rays, MRIs & CT scans, chronic illnesses including cancer and diabetes, prescription medications, prescription diets, and surgeries & hospitalization.